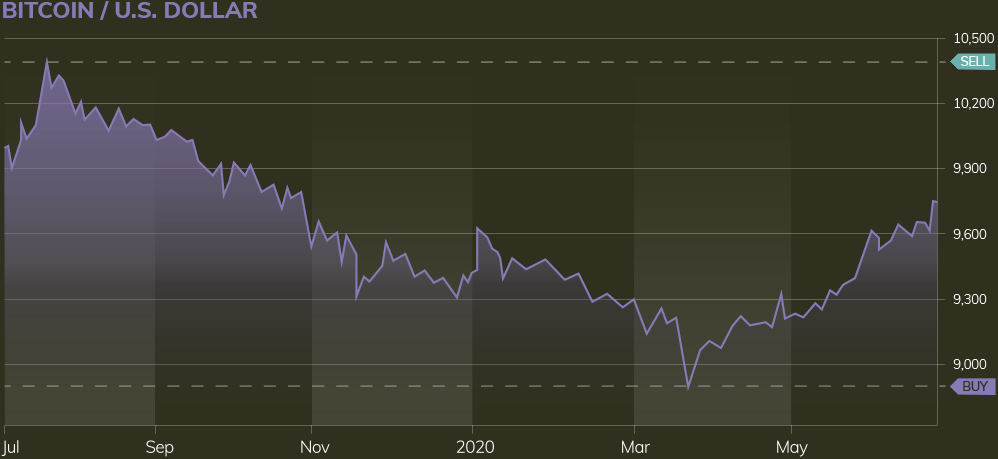

Trading Cryptocurrencies with ExpressOptions is like trading FX, however, instead of buying or selling an amount of base currency against a counter currency, you are buying or selling a number of units of a Cryptocurrency against the US dollar. For example, one contract of XRPUSD is 100 ‘Ripple’ coins while one contract of BTCUSD is 1 Bitcoin. Cryptocurrencies trade almost 24/5, have overnight financing and do not expire.

Cryptocurrency CFDs work in an almost identical way to buying the actual Cryptocurrency from a crypto exchange. The key differences being the leverage involved (if any), your counterparty risk on the trade being ExpressOptions and not the crypto exchange, and that you own the CFD and not the underlying Cryptocurrency. Eliminating the risk of hacking, theft, counterparty risk from the exchange, etc. is the main reason a trader would use a Cryptocurrency CFD over going to an exchange.